Tax impacts for Real Estate Investors from the recently signed H.R 1 – One Big Beautiful Bill

Edited by Cliff Hockley, Assembled from many internet sources including Chat GPT

The real name of the “One Big Beautiful Bill” is H.R. 1 – One Big Beautiful Bill Act in the 119th Congress. It is a comprehensive tax legislation that was recently signed into law by President Trump. This bill makes significant changes to the tax code including extending provisions from the tax cuts and JOBS Act. We have assembled a summary of key real estate related tax issues for you to review. Please consult your CPA and Tax attorney before you make any decisions.

Increased Standard Deduction

The bill makes the larger standard deduction created under the TCJA permanent.

Additionally, the amounts for 2025 are slightly expanded.

Single or Married Filing Separately — $15,750

Head of Household — $23,625

Married Filing Jointly or Qualifying Surviving Spouse — $31,500

Income tax rates

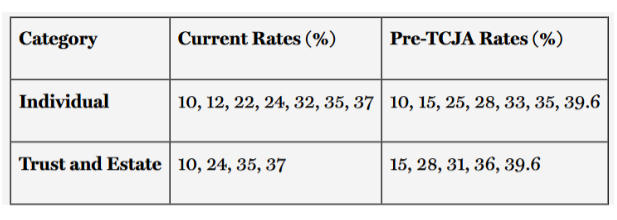

The legislation generally makes permanent the seven rates created by the TCJA, with an initial inflation adjustment in 2026 for the first two brackets (10%, 12%).

The permanent brackets are: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

https://www.huschblackwell.com/newsandinsights/estate-planning-and-other-tax-strategies-under-the-one-big-beautiful-bill-act#:~:text=The%20federal%20estate%20and%20gift,tax%20in%202026%20and%20beyond.

Increased deduction for seniors

Effective: 2025–2028

In addition to the standard deduction or itemized deduction, taxpayers 65 and older will be able to take an additional $6,000 off of their taxable income.

Starts to decrease for taxpayers with a Modified Adjusted Gross Income (MAGI) over $75,000 (single) / $150,000 (joint).

Requires a Social Security number valid for work.

Not available for those using the Married Filing Separately status.

https://www.hrblock.com/tax-center/irs/tax-law-and-policy/one-big-beautiful-bill-taxes/?srsltid=AfmBOoqk2ZDFeb-C2-i9ZY4jGIvTx2lbdwAefUk-9GJJ7nzGkRjqqtUg

Corporate tax rate and deductions

Permanent corporate tax rate: The Act maintains the corporate tax rate at 21%, permanently extending the rate reduction enacted by the 2017 Tax Cuts and Jobs Act (TCJA). This stability in the corporate tax rate allows businesses including real estate sponsors developers and institutional investors greater long- term certainty for structuring deals and forecasting after tax returns.

Additionally, the bill solidifies the 20% deduction for qualified business income parentheses Q BI from pass through entities such as LLCs and partnerships. Given that much of the CRE commercial real estate market relies on these structures this is a significant win, lowering tax burden for many investors and operators.

https://www.baselane.com/resources/one-big-beautiful-bill-real-estate-investors/

Opportunity Zones

Opportunity zones introduced in the 2017 tax overhaul are now permanent. Under this new legislation the program continues to encourage investments in designated low-income areas by allowing investors to defer and potentially reduce capital gains taxes.

This law tightens eligibility by lowering the qualifying income threshold for opportunity zone tracts to 70% of area median income from 80% and removes the option to include areas adjacent to low-income tracts it also introduces standardized benefits of five-year rolling deferral program that starts each individual’s investment date provides clearer timelines

The bill also introduces specific provisions aimed at encouraging investment in rural real estate. Lenders can now exclude up to 25% of interest income on rural and agricultural real estate loans through 2028.

This change is intended to make financing for rural property investments more attractive, potentially increasing demand and development in these areas.

https://www.baselane.com/resources/one-big-beautiful-bill-real-estate-investors/

Bonus depreciation

A particular impactful provision for commercial real estate if the expansion of the 100% bonus depreciation to include real estate assets. This means investors and developers can now deduct the full cost of qualifying property improvements in the first year rather than over decades (15, 27.5 or 39 years) . This change now enables the write-off in year 1 which can generate near term significant savings. This applies to buildings placed into service after 19 January 2025.

Expanded Section 179 expensing with an eye towards tenant improvements

Increased Deduction Limits: The Act raised the maximum Section 179 deduction to $2.5 million, with a phase-out threshold of $4 million, for tax years starting after December 31, 2024. These figures are indexed for inflation for subsequent years.

Expanded Scope for Improvements: Previously, Section 179’s application to real estate improvements was limited. However, the OBBBA now allows the immediate expensing of the full cost of qualified improvements made to the interior of non-residential real property under Section 179.

Qualified Improvement Property (QIP) Eligibility: Tenant improvements classified as QIP, defined as improvements to the interior portion of non-residential real property placed in service after the building was first placed in service, are eligible for Section 179 expensing under the new law, provided they are not for the enlargement of the building, elevators or escalators, or the internal structural framework.

Examples of Qualifying Improvements: This expansion includes the immediate expensing of costs related to new roofs, HVAC systems, fire protection and alarm systems, and security systems installed in non-residential properties after the building’s initial placement in service.

Strategic Planning: Real estate businesses, particularly those with mid-sized portfolios, can strategically combine expanded Section 179 expensing with bonus depreciation to optimize project-level tax efficiency.

The Act does, however, phase out certain clean energy tax incentives that have long been in the tax law. For example, the section 179D deduction for energy- efficient commercial buildings is repealed for projects that begin construction after June 30, 2026.

https://www.nar.realtor/washington-report/big-beautiful-tax-bill-now-law-in-depth-analysis

Mortgage Interest and SALT Deduction Updates

The “One Big Beautiful Bill Act” includes updates relevant to homeowners and potentially investors with residential properties. While the core mortgage interest deduction remains, the bill makes changes to the State and Local Tax (SALT) deduction.

The SALT deduction cap is increased from $10,000 to $40,000 for 2025. This higher cap applies to individuals and is $20,000 for those who are married filing separately.

The increased SALT cap is particularly meaningful for real estate investors who pay high property taxes and income taxes in states like California and New York. This change offers potentially significant relief by allowing them to deduct a larger portion of these taxes.

The higher deduction goes down as your Modified Adjusted Gross Income (MAGI) goes up.

The SALT deduction has never been limited to taxes on a primary residence. You can deduct property taxes paid on second homes, vacation homes, or investment properties, subject to the overall cap. However, the mortgage interest deduction—a separate itemized deduction—is generally limited to interest on your primary residence (and, in some cases, a second home).

https://www.baselane.com/resources/one-big-beautiful-bill-real-estate-investors/

Low-Income Housing Tax Credit (LIHTC) Enhancements

The bill makes changes to the LIHTC program, including restoring the 9% LIHTC to its 2021 level and lowering the bond-financing threshold for the 4% LIHTC.

The bill significantly enhances the low-income housing tax credit marking what advocates call the biggest investment in the program in 25 years it reduces the 50% test for tax exempt bond financing to 25% makes the funding permanent which should help clear backlogs of affordable housing projects.

Additionally, the new markets tax credit is now permanently funded at 5 billion annually which should bring stability to investments to support economic development in underserved communities.

Federal Estate Tax Regulations – benefits for heirs and trusts

The OBBBA permanently raises the federal estate and gift tax exemption amount to $15 million per individual, up from the current $13.99 million

Inflation Indexing: This new exemption amount will be adjusted annually for inflation, starting in 2026.

Estate Tax Rate: The federal estate tax rate remains at a maximum of 40%.

Portability: The unlimited marital deduction and portability provisions remain in effect, meaning a surviving spouse can utilize any unused portion of their deceased spouse’s exemption, potentially allowing for the transfer of up to $30 million without incurring federal estate taxes.

The OBBBA also adjusts the generation-skipping transfer (GST) tax exemption to match the increased estate and gift tax exemption.

While the federal exemption has increased, individuals and families should be aware that state-level estate taxes and exemptions may differ significantly from the federal rules. For instance, New York’s estate tax exemption in 2025 is $7,160,000, significantly lower than the federal exemption.

https://www.huschblackwell.com/newsandinsights/estate-planning-and-other-tax-strategies-under-the-one-big-beautiful-bill-act#:~:text=The%20federal%20estate%20and%20gift,tax%20in%202026%20and%20beyond.

1031 Exchanges to remain in place

No limitations or repeal of section 1031 like-kind exchanges. For many years, some in Congress have sought to take away some or all the benefits of this vital tax deferral tool that increases economic growth and creates jobs. It is not touched by the Act.

https://www.nar.realtor/washington-report/big-beautiful-tax-bill-now-law-in-depth-analysis

Real Estate Investment Trusts (REIT)

The bill raises the cap on investments in taxable REIT subsidiaries from 20% to 25% of total assets, this offers more operational flexibility for REITS looking to engage in businesses that might otherwise threaten their tax advantage status such as providing specialized services to tenants.

University Endowments

Conversely new steep taxes on large university endowments could indirectly affect commercial real estate. Universities are both substantial real estate owners and significant investors in private equity and real estate funds. Tighter cash flows from higher tax bills may dampen the endowment allocations to alternative assets including real estate and slow campus expansion projects and investments that drive endowment growth.

As you can see, there are many positive real estate centric changes to current tax laws. As stated above, please consult your CPA and Tax attorney before you make any decisions.

This summary is meant to create a simple reference jumping off point not an in-depth study of the tax law changes contained in the H.R.1.

Clifford A. Hockley, CPM, CCIM, MBA

Cliff is a Certified Property Manager® (CPM) and a Certified Commercial Investment Member (CCIM). Cliff joined Bluestone and Hockley Real Estate Services in 1986 and successfully grew the company from 10 to almost 100 employees, with over Two Billion dollars of real estate under management. He then merged with Criteria Properties in 2021 to establish Bluestone Real Estate Services, where he still serves as an associate broker.

In 2023, Cliff formed a real estate consulting practice, Cliff Hockley Consulting, LLC. designed to help real estate business owners, managers and investors improve their bottom line.

Cliff holds an MBA from Willamette University and a BS in Political Science from Claremont McKenna College. He is a frequent contributor to industry newsletters and served as adjunct professor at Portland State University, where he taught real estate related topics.

Cliff is the author of two books 21 Fables and Successful Real Estate Investing: Invest Wisely Avoid Costly Mistakes and Make Money, books that help investors navigate the rough shoals of real estate ownership. He can be reached at 503-267-1909, Cliffhockley@Outlook.com.